Introduction

Unlocking the Mysteries of Insurance Claims

Imagine waking up to a sudden downpour, only to discover water dripping from your ceiling. Your roof, a silent guardian, has succumbed to the elements. In such moments of crisis, understanding the intricacies of filing a roof insurance claim becomes crucial. This comprehensive guide delves into the nitty-gritty of roof insurance claims, enlightening you on the process, the challenges, and the steps to ensure a smooth resolution.

Exploring Your Roof’s Vulnerabilities

Your roof, a resilient shield against nature’s wrath, is susceptible to various forms of . From storms and hail to the slow wear and tear over time, understanding the types of damage your roof might face is essential. Whether it’s a sudden leak or a gradual decline in structural integrity, recognizing the signs early on can significantly impact the insurance claim process.

The age of your roof is a critical factor. Insurance companies may scrutinize claims differently based on the age of the roof. An older roof may face challenges in getting full coverage for repairs or replacement, making it imperative to know the age of your roof when filing a claim.

Read More: Signs You Need a New Roof or Roof Replacement

Initiating the Insurance Claim Process

The first steps after discovering roof damage are crucial for a successful insurance claim. Prompt action is essential. Document the damage thoroughly, taking photographs and making notes. Reach out to your insurance company as soon as possible, providing them with detailed information about the incident.

Remember, the more comprehensive and well-documented your claim, the smoother the process is likely to be. Insurance companies typically appreciate timely and detailed information to expedite the assessment of your claim.

Navigating the Insurance Industry Landscape

Understanding how insurance companies assess roof damage claims is pivotal. Insurance adjusters play a crucial role in this process. They inspect the damage, evaluate the documentation provided, and determine whether the claim should be approved or denied.

However, the claim process isn’t always straightforward. Various factors, such as the age of the roof and the nature of the damage, can influence the outcome. It’s essential to be aware of potential pitfalls that may lead to claim denials and to address them proactively.

Role of the Roofing Professional

When facing roof damage, calling a roofing contractor is often a homeowner’s immediate response. These professionals not only repair or replace your roof but can also assist in the insurance claim process. An experienced roofing professional inspect your roof and provide a detailed assessment of the damage, document it effectively, and communicate with the insurance company on your behalf.

Their expertise is invaluable in navigating the complexities of Claim with your insurance, ensuring that your interests are represented accurately. Collaboration with a roofing contractor can significantly enhance the chances of a successful claim resolution.

Deciphering the Insurance Adjuster’s Role

Insurance adjusters act as the eyes of the insurance company during the claim process. They inspect the damage, assess its extent, and determine the validity of the claim. Homeowners can support their claims during the adjuster’s inspection by providing additional documentation, such as repair estimates from roofing professionals and photographs of the damage.

Understanding the role of the insurance adjuster and cooperating effectively can contribute to a smoother claim process. It’s crucial to be proactive and prepared when dealing with the adjuster, ensuring that all relevant information is readily available.

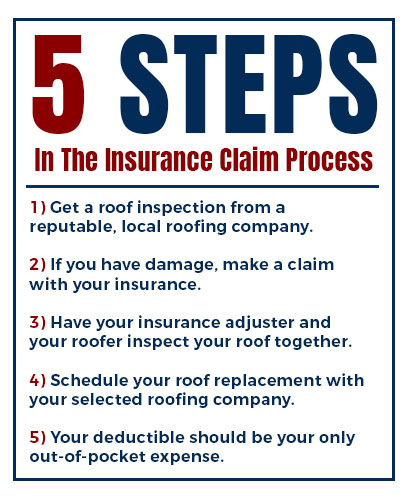

Crucial Steps in Filing a Roof Insurance Claim

Filing a roof insurance claim involves several critical steps. From gathering information about the incident to submitting the claim, homeowners must follow a structured process. Providing accurate and detailed information when filing a claim can significantly impact its success.

What do you need to file a claim, and how can you ensure a smooth process? Understanding the specific requirements of Claim with your insurance Company and tailoring your approach accordingly can make a substantial difference in the outcome of your claim.

Understanding Insurance Policies and Coverage

Homeowners insurance policies vary in coverage, and understanding the specifics is crucial when filing a roof insurance claim. What does your policy typically cover, and are there specific types of roof damage excluded from coverage? Knowing the ins and outs of your insurance policy ensures that you are well-prepared when facing roof damage.

It’s also essential to be aware of potential areas of damage that your policy may not cover. This knowledge empowers homeowners to make informed decisions and, if necessary, explore additional coverage options.

Roof Replacement vs. Repair

When faced with significant roof damage, the decision between Roof repair and replacement becomes paramount. Insurance coverage for a new roof may depend on various factors, such as the age of your roof and the extent of the damage. Understanding the criteria insurance companies use to determine coverage for roof replacement can guide homeowners in making informed decisions.

The cost of a new roof is a crucial consideration. Homeowners should be aware of the financial implications and explore options for coverage that align with their needs. The choice between roof replacement and Roof repair can significantly impact the overall claim process.

Dealing with Insurance Companies

Effectively communicating with your insurance company is key to a successful roof insurance claim. Promptly reporting the damage, providing necessary documentation, and maintaining clear and open lines of communication contribute to a smoother process. However, challenges may arise, such as delays in the claim process.

What steps can homeowners take to navigate potential delays and ensure a timely resolution? Understanding how insurance companies operate and being proactive in addressing any hurdles can expedite the overall process.

Preventing Future Roof Damage

Once the insurance claim process is complete, it’s crucial to take proactive measures to prevent future roof damage. Regular roof inspections, timely repairs, and proactive maintenance can extend the lifespan of your roof and minimize the risk of future claims.

Homeowners should also be aware of factors that could contribute to roof damage, such as the age of the roof and environmental conditions. By addressing potential issues early on, homeowners can mitigate the risk of extensive damage and subsequent insurance claims.

Conclusion: Key Takeaways

In summary, filing a roof insurance claim involves a nuanced process that requires a combination of proactive steps, effective communication, and a thorough understanding of insurance policies. Key takeaways from this comprehensive guide include:

- Prompt Action: Act swiftly when you discover roof damage to initiate the claim process promptly.

- Documentation is Key: Thoroughly document the damage with photographs and detailed notes to support your claim.

- Professional Assistance: Collaborate with a roofing contractor for an expert assessment and assistance throughout the claim process.

- Understanding Insurance Policies: Know the specifics of your homeowners insurance policy, including coverage and potential exclusions.

- Effective Communication: Maintain open and clear communication with your insurance company, addressing any delays proactively.

- Preventive Measures: Take proactive steps to prevent future roof damage through regular inspections and maintenance.

By incorporating these key takeaways, homeowners can navigate the roof insurance claim process with greater confidence and increase the likelihood of a successful resolution. Remember, understanding the nuances of the process is the first step toward safeguarding your home and ensuring that your roof continues to provide the protection it was designed for.